What is the best ERP for pharmaceuticals? Best Pharma ERP Systems 2023

Best pharma ERP software and the top pharma manufacturing ERP modules that SME and large pharmaceutical companies need in Cloud and On Premise ERP.

Pharmaceutical ERP systems can help your organisation to boost productivity and efficiency, manage compliance and ...

Pharmaceutical ERP systems can help your organisation to boost productivity and efficiency, manage compliance and ultimately protect the bottom line whilst delivering exceptional customer experiences.

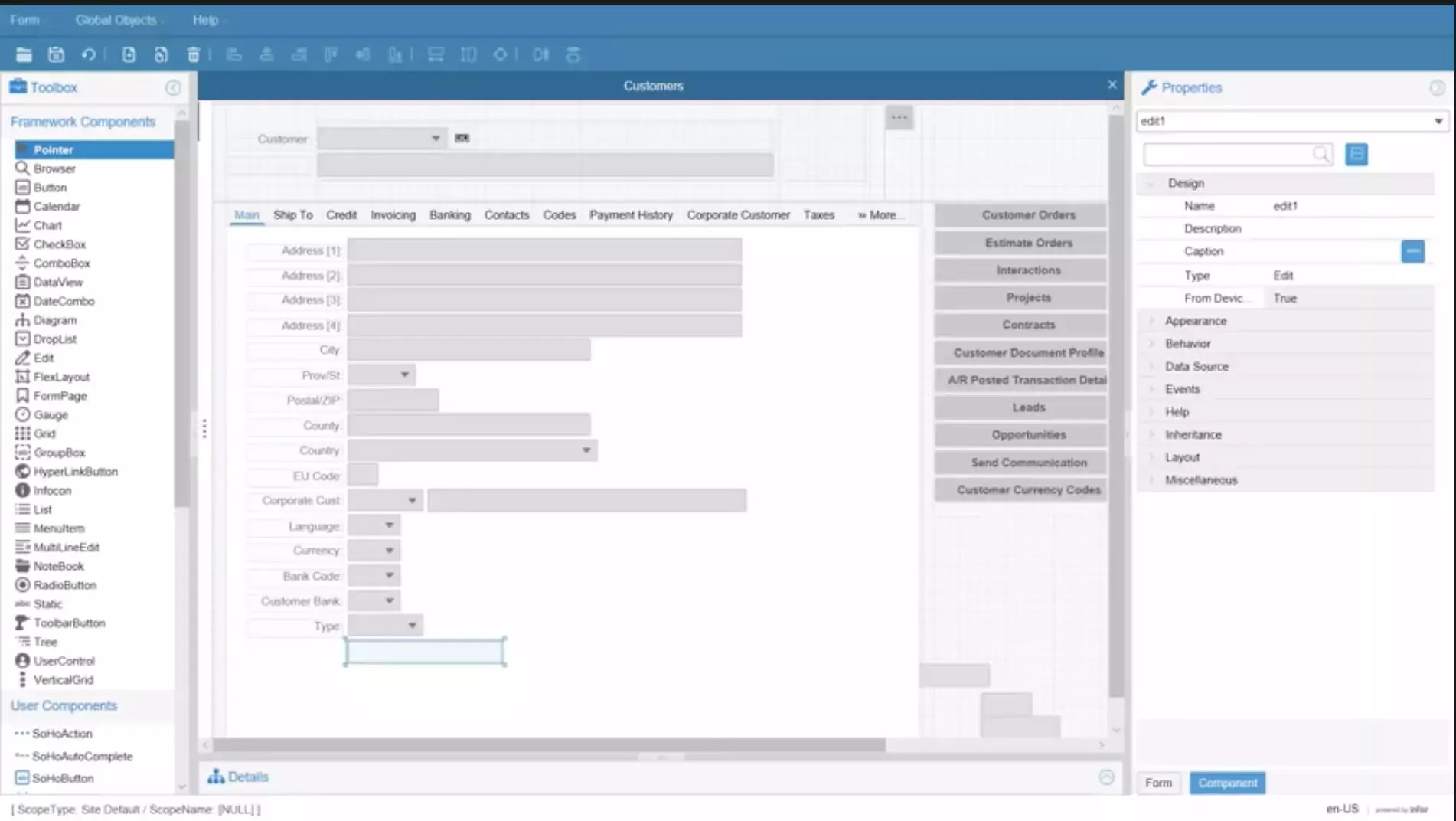

However in 2024 there are a lot of options on the market when you're evaluating ERP systems for pharmaceuticals. It can be hard to choose between established pharma ERP vendors like SAP, Infor and Epicor or new entrants to the market.

We'll explore some of the best ERP for pharma in this article and explore some of the frequently asked questions in our full ERP for pharmaceuticals guide.

Best Pharma ERP Software

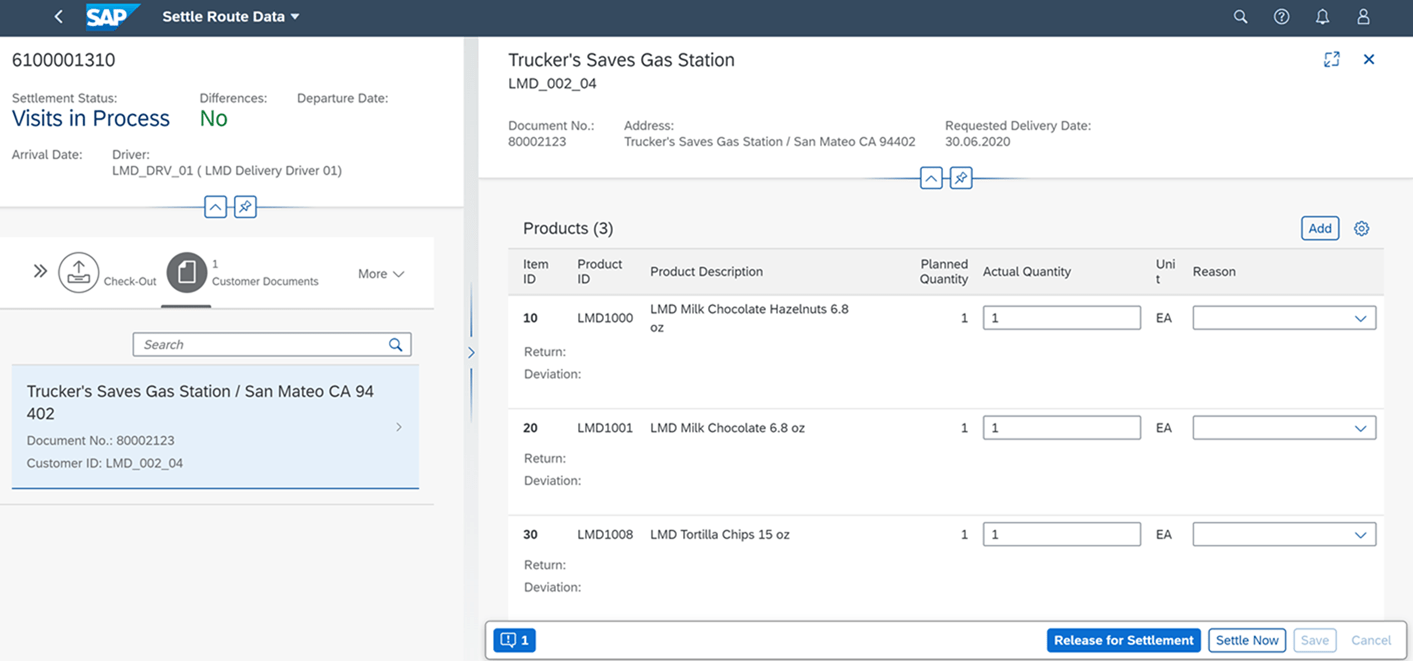

2. Infor CloudSuite Industrial

6. Microsoft Dynamics Business Central

Frequenty Asked Questions

How do I compare ERP for pharma?

What are the features and modules of Pharmaceutical ERP?

How much does Pharma ERP cost?

How long does it take to implement an ERP in the pharmaceutical industry?

| Pharma ERP System | Cost: | Scalability: | Deployment: |

| SAP S/4 HANA | High | 100 - 10,000+ employees | On-Premise or Cloud |

| Infor CloudSuite | Medium | 100 - 5,000 employees | Cloud |

| Epicor Kinetic | Low | 50 - 500 employees | Cloud |

| Oracle NetSuite | Medium | 50 - 1,000 employees | Cloud |

| Dynamics Business Central | Low | 50 - 500 employees | Cloud or On-Premise |

| Oracle ERP Cloud | Medium | 201 - 10,000 employees | Cloud |

| SYSPRO | Low | 50 - 500 employees | Cloud or On-Premise |

| SAP Business One | Low | 50 - 500 employees | On-Premise or Cloud |

| QAD | Medium | 201 - 5,000 employees | Cloud or On-Premise |

| Microsoft Dynamics | Medium | 201 - 10,000 employees | Cloud |

Top 10 Pharmaceutical ERP Report

SAP S/4HANA is a powerful, cloud-based ERP solution designed for various industries, including pharmaceuticals. It’s known for its real-time data processing and advanced analytics, making it suitable for a wide range of pharmaceutical companies like R&D firms, generic drug manufacturers, biopharmaceutical companies, CROs, CMOs, and specialty pharma companies. S/4HANA excels in areas such as financial management, supply chain logistics, and compliance.

For R&D companies, S/4HANA offers robust financial and project management tools but may require integration with specialized software for detailed clinical trial management. Generic drug manufacturers benefit from its comprehensive supply chain and quality control features, though complex production processes might need additional customization. Biopharmaceutical companies leverage its advanced analytics and compliance capabilities, but managing intricate bioprocessing operations often calls for further integrations.

S/4HANA’s project and financial management tools are ideal for CROs, while CMOs can utilize its manufacturing and supply chain modules. However, more complex manufacturing setups may need further customization. Specialty pharmaceutical companies appreciate its CRM and marketing capabilities, though unique manufacturing or distribution needs might require additional adjustments.

SAP S/4HANA is a robust and versatile solution, particularly strong in financials, supply chain management, and advanced analytics. However, it often needs significant customization for specialized needs like clinical trial management and advanced manufacturing processes.

The platform is user-friendly and extremely scalable, but the implementation can be complex and expensive, especially for smaller companies.

| COST: | DEPLOYMENT: | SCALABILITY: |

| Medium - High | Cloud | 201 - 5,000 employeess |

Infor CloudSuite Industrial (CSI) is a cloud-based ERP solution tailored for manufacturing industries, including pharmaceuticals. It's known for its flexibility, scalability, and industry-specific features, making it suitable for various pharmaceutical companies such as R&D firms, generic drug manufacturers, biopharmaceutical companies, CROs, CMOs, and specialty pharma companies. CSI excels in manufacturing processes, supply chain management, and quality control.

For R&D companies, Infor CSI provides strong project management and financial tracking capabilities but might require integration with specialized software for clinical trial management and advanced research needs. Generic drug manufacturers benefit from its robust manufacturing and quality control features, though highly complex production processes might need additional customization. Biopharmaceutical companies leverage its comprehensive supply chain and compliance capabilities, but managing intricate bioprocessing operations often calls for further integrations.

Infor CSI’s project and financial management tools are well-suited for CROs, while CMOs can utilize its extensive manufacturing and quality control modules. However, more complex manufacturing setups may need further customization. Specialty pharmaceutical companies appreciate its CRM, sales, and marketing capabilities, though unique manufacturing or distribution needs might require additional adjustments.

| COST: | DEPLOYMENT: | SCALABILITY: |

| Medium | Cloud | 201 - 5,000 employeess |

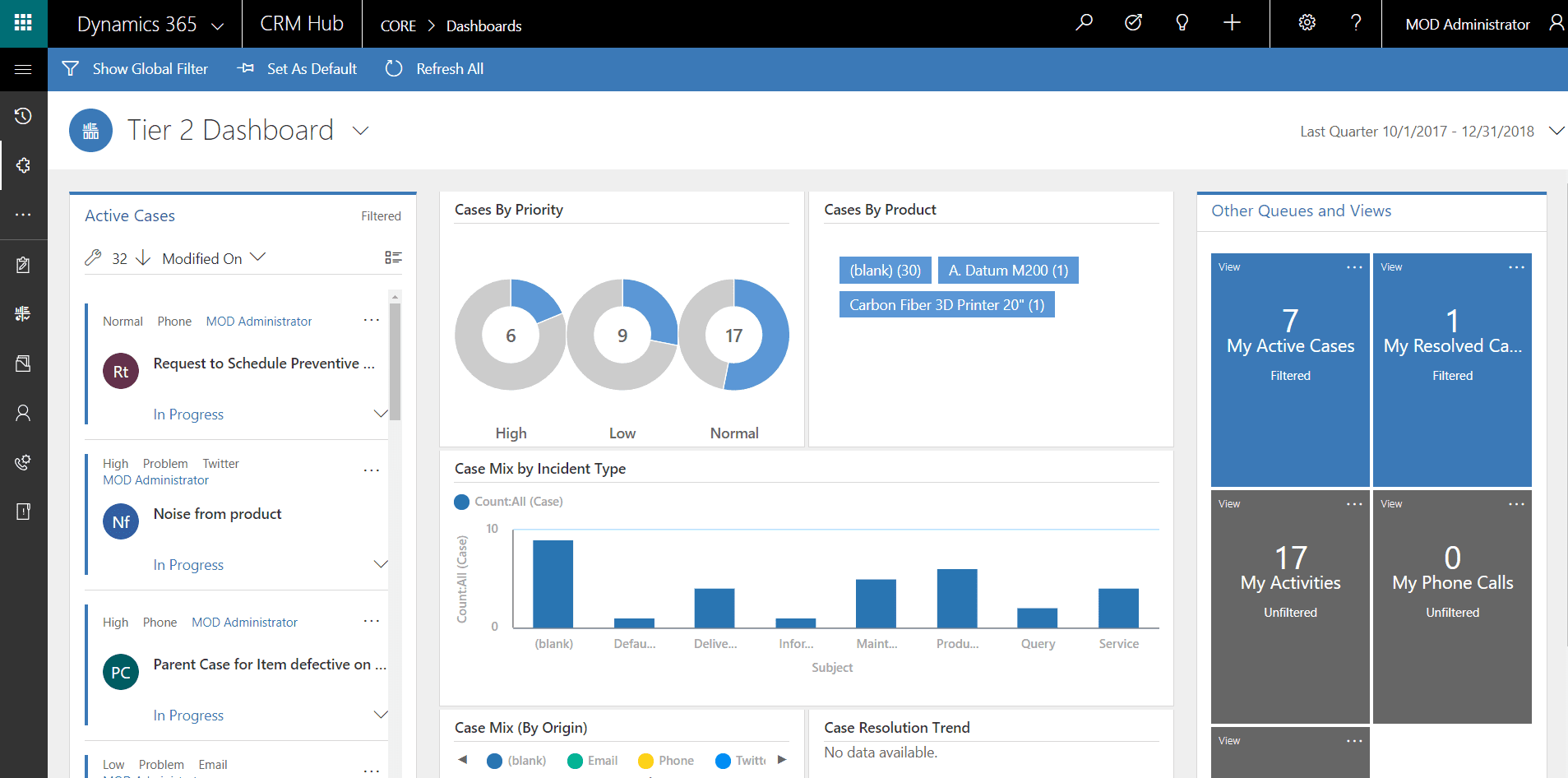

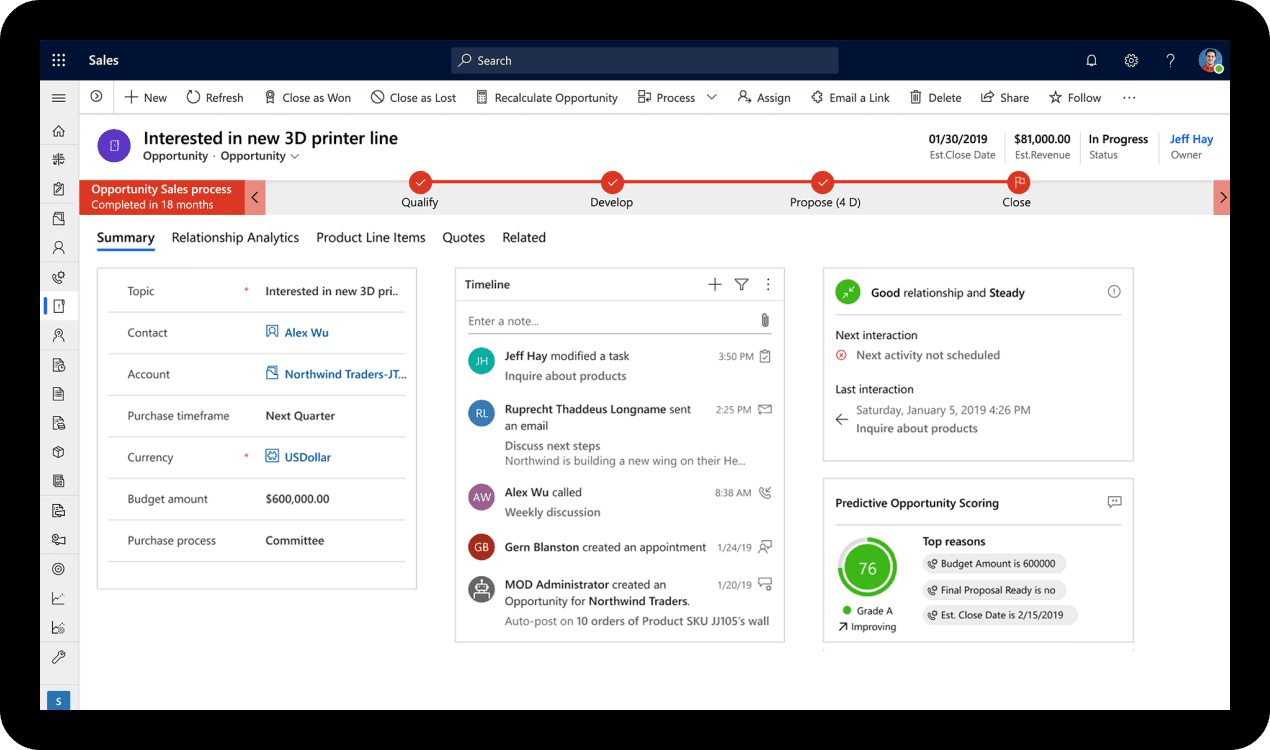

Microsoft Dynamics 365 is a comprehensive cloud-based ERP and CRM solution that caters to a wide range of industries, including pharmaceuticals. Known for its integration capabilities, real-time data analytics, and user-friendly interface, Dynamics 365 is suitable for various pharmaceutical companies, including R&D firms, generic drug manufacturers, biopharmaceutical companies, CROs, CMOs, and specialty pharma companies.

R&D firms can leverage Dynamics 365 for its robust project management, financial tracking, and compliance features. However, for detailed clinical trial management and advanced research processes, additional integration with specialized software may be necessary. Generic drug manufacturers benefit from the platform's strong inventory management, supply chain logistics, and quality control capabilities, though more complex manufacturing processes might require further customization.

Biopharmaceutical companies appreciate Dynamics 365's advanced analytics, financial management, and compliance tools, but managing intricate bioprocessing operations often calls for integrating specialized systems. CROs can utilize Dynamics 365's project and financial management modules effectively, although clinical trial management might need additional tailored solutions.

For CMOs, Dynamics 365 offers comprehensive manufacturing, supply chain, and quality control features. However, companies with complex manufacturing setups may still need customization. Specialty pharmaceutical companies benefit from its CRM, sales, and marketing capabilities, though unique manufacturing or distribution requirements might necessitate further adjustments.

Microsoft Dynamics 365 stands out for its seamless integration with other Microsoft products, real-time data insights, and scalability. It’s particularly strong in financial management, supply chain logistics, and CRM functionalities. However, specialized needs such as clinical trial management and advanced manufacturing processes often require significant customization or integration with niche solutions.

While the platform is user-friendly and scalable, the implementation can be complex and potentially expensive, particularly for smaller companies or those with very specific requirements.

| COST: | DEPLOYMENT: | SCALABILITY: |

| Medium | Cloud | 201-5,000 employeess |

In our advisory capacity within the pharmaceutical industry, we have found that Epicor Kinetic is a well-suited ERP system for small to mid-sized pharmaceutical companies needing a robust and adaptable solution. Its strong focus on manufacturing and production management makes it particularly attractive to companies managing both in-house and outsourced production processes.

Pharmaceutical and biotechnology firms at various stages of their development appreciate Epicor Kinetic's comprehensive support for manufacturing processes and its flexibility to adapt to changing production requirements. We have observed that while it excels in production and supply chain management, it may face limitations in handling the most stringent regulatory requirements of the pharmaceutical industry.

Epicor Kinetic provides a broad range of modules, including finance, inventory management, production, and supply chain capabilities. As a Cloud ERP system, it offers scalability and user-friendliness, making it ideal for companies with limited IT resources that require a system capable of supporting their manufacturing operations.

| COST: | DEPLOYMENT: | SCALABILITY: |

| Medium | Cloud | 201-5,000 employeess |

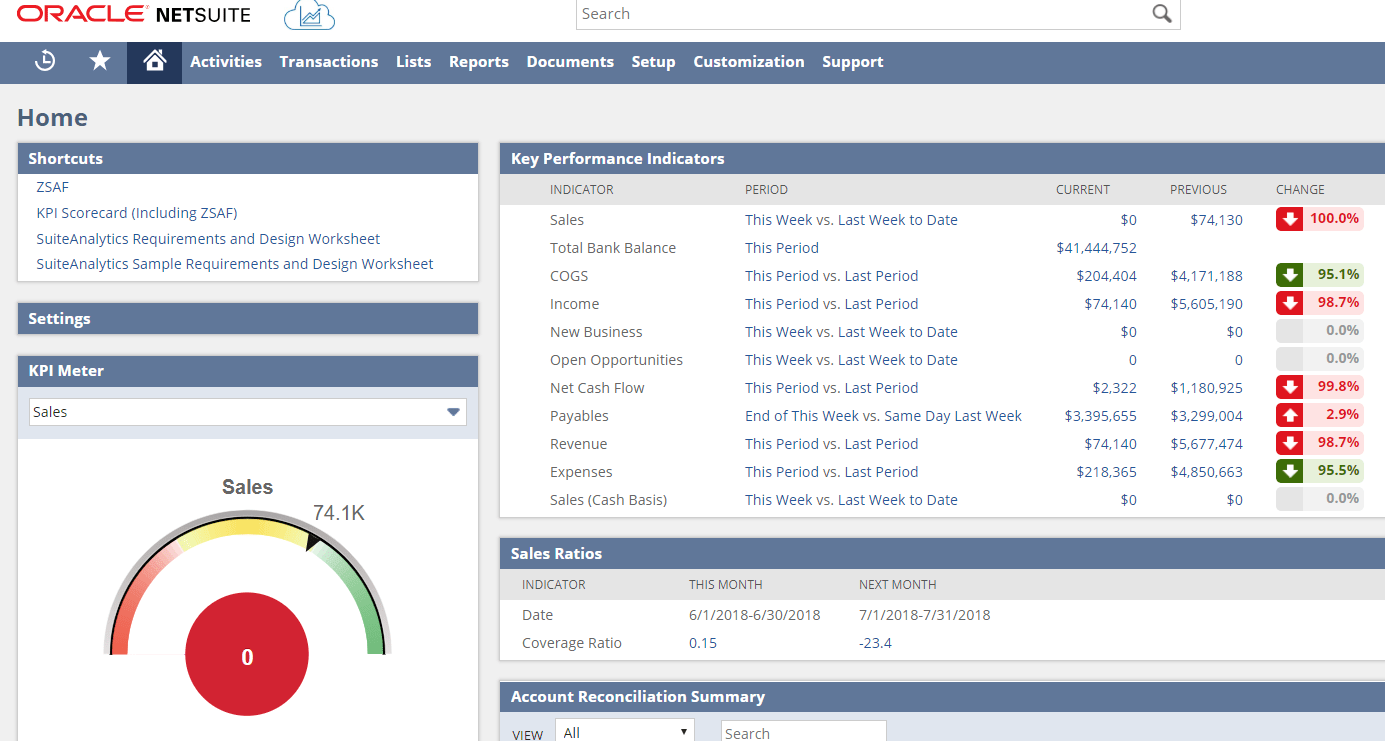

Oracle NetSuite ERP is a cloud-based solution designed to manage various business processes across different industries, including pharmaceuticals. It's flexible and scalable, making it a good fit for many types of pharmaceutical companies, such as R&D firms, generic drug manufacturers, biopharmaceutical companies, CROs, CMOs, and specialty pharma companies. Its strengths lie in robust financial management, inventory control, and supply chain management.

For R&D companies, NetSuite excels in managing financials, project tracking, and compliance but might need integration with specialized software for clinical trials. Generic drug manufacturers benefit from its inventory and quality control features, though complex manufacturing processes might require customization. Biopharmaceutical companies appreciate its financial management and compliance tools, but advanced bioprocessing operations often need additional integrations.

NetSuite’s project management and financial tracking are great for CROs, and CMOs can take advantage of its manufacturing and quality control capabilities. However, more complex manufacturing setups may still need extra customization. Specialty pharmaceutical companies find its CRM, sales, and marketing modules useful, though unique manufacturing or distribution needs might call for further tweaks.

We’ve seen NetSuite be a versatile and powerful tool, particularly for financials, inventory, and supply chain efficiency. However, it often requires significant customization for specialized needs like clinical trial management and advanced manufacturing. The platform is user-friendly and scalable but can be complex and costly to implement, especially for smaller companies.

| COST: | DEPLOYMENT: | SCALABILITY: |

| Medium | Cloud | 201-5,000 employeess |

Microsoft Dynamics 365 Business Central is a favored choice for small to mid-sized pharmaceutical companies. Its seamless integration with other Microsoft products makes it an attractive option for firms already embedded in the Microsoft ecosystem.

Pharmaceutical and biotechnology companies in the growth phase often choose Dynamics 365 Business Central for its comprehensive project management, financial, and supply chain modules, which are crucial during the transition from research and development to production. However, it may face challenges in supporting highly specialized manufacturing processes and complex regulatory requirements.

Dynamics 365 Business Central provides a wide range of functionalities, including finance, sales, customer service, and supply chain management. Its Cloud-based nature ensures scalability and ease of access, making it suitable for companies with moderate IT resources that need an integrated and flexible ERP solution. This system allows companies to efficiently manage their operations while benefiting from the robust support and integration capabilities of the Microsoft platform.

| COST: | DEPLOYMENT: | SCALABILITY: |

| Medium | Cloud | 201-5,000 employeess |

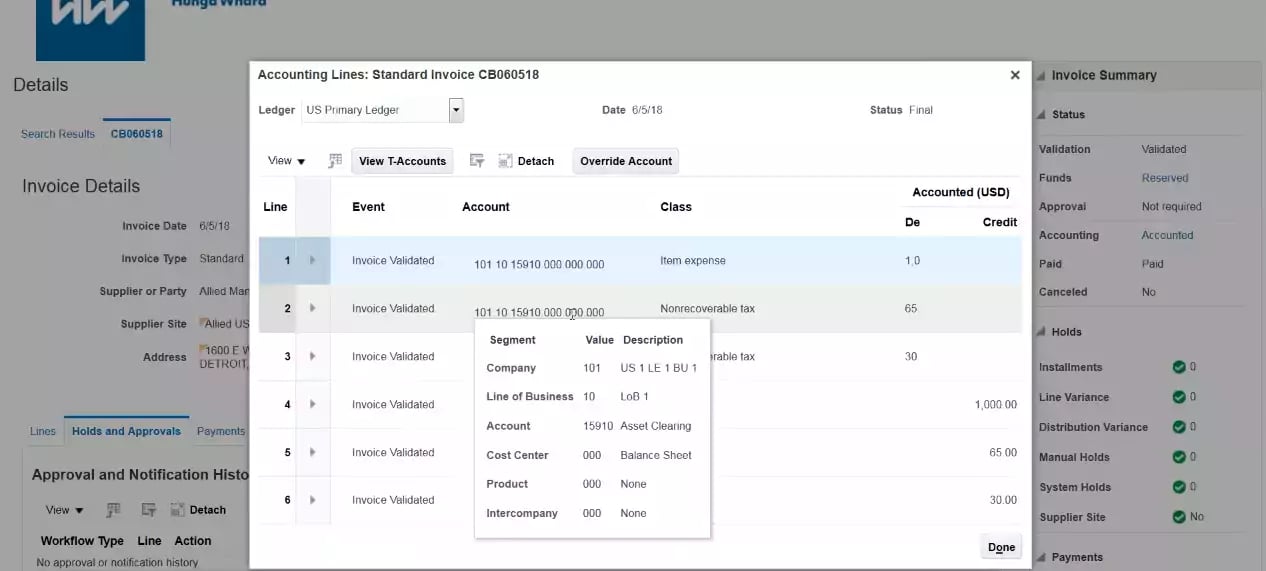

Oracle ERP Cloud is a robust cloud-based ERP solution ideal for various pharmaceutical companies, including R&D firms, generic drug manufacturers, biopharmaceutical companies, CROs, CMOs, and specialty pharma companies. It's renowned for advanced financial management, real-time analytics, and an integrated suite of applications.

R&D firms benefit from its strong project management, financial tracking, and compliance tools, though integration with specialized systems is often needed for detailed clinical trials. Generic drug manufacturers leverage its robust supply chain, inventory control, and quality assurance features, while complex production processes might require customization. Biopharmaceutical companies appreciate its financial management and compliance capabilities but may need specialized systems for intricate bioprocessing.

CROs find the project and financial management tools effective, though clinical trial management might need tailored solutions. CMOs benefit from comprehensive manufacturing, supply chain, and quality control features but may require customization for complex setups. Specialty pharma companies utilize the CRM, sales, and marketing capabilities, although unique manufacturing needs might need further adjustments.

We’ve seen Oracle ERP Cloud excel in financial management and real-time analytics, offering valuable insights and integrated operations. However, specialized needs often require customization or integration with niche solutions. While user-friendly and scalable, implementation can be complex and costly, especially for smaller companies with specific requirements. Overall, it's a powerful tool for comprehensive ERP needs in the pharmaceutical industry.

| COST: | DEPLOYMENT: | SCALABILITY: |

| Medium - High | Cloud | 201-10,000 employeess |

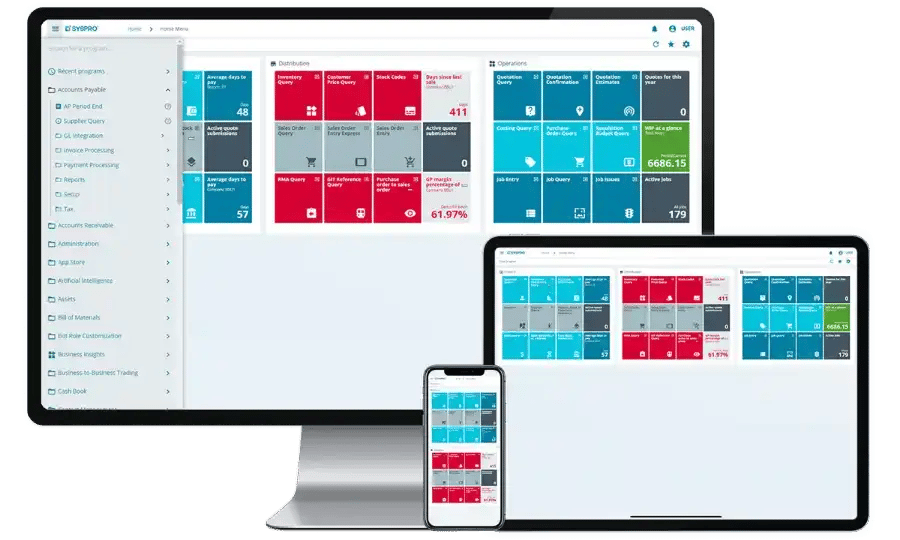

SYSPRO is a preferred ERP system for small to medium-sized pharmaceutical companies seeking a balance between comprehensive functionality and ease of use. SYSPRO is particularly well-suited for companies that require strong manufacturing and distribution capabilities.

Pharmaceutical and biotechnology firms in the early to mid-stages of their lifecycle often opt for SYSPRO due to its robust support for production management, inventory control, and financial management. It is effective in managing both in-house and outsourced production processes, although it may face limitations when dealing with the most stringent regulatory demands.

SYSPRO provides an array of modules tailored for pharmaceutical businesses, including finance, inventory management, production, and distribution. As a Cloud ERP system, SYSPRO offers scalability and ease of deployment, making it suitable for companies with moderate IT resources that need a reliable and flexible ERP solution to support their manufacturing operations and regulatory compliance.

| COST: | DEPLOYMENT: | SCALABILITY: |

| Low - Medium | Hybrid | 51 - 500 employeess |

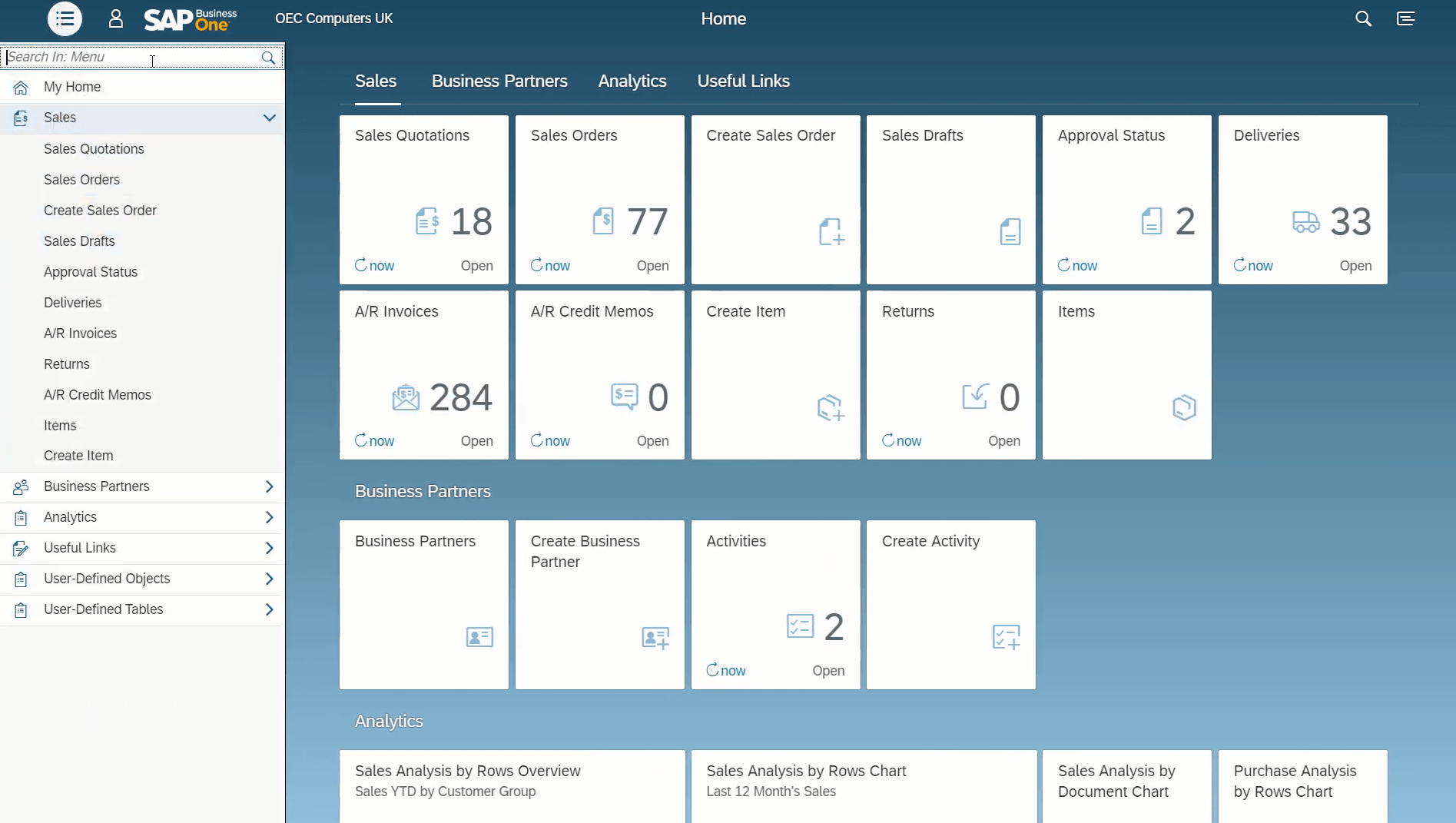

SAP Business One is a favored choice among small to medium-sized pharmaceutical companies and subsidiaries of larger pharmaceutical firms due to its comprehensive yet straightforward approach. However, it may face limitations in addressing complex manufacturing requirements and stringent regulatory demands.

Pharmaceutical and biotechnology firms in their early stages of development often opt for SAP Business One due to its robust financial management and inventory control features, which are crucial for managing research and development activities. As these companies scale up to in-house or outsourced production, they may find that SAP Business One lacks some of the advanced supply chain and production capabilities needed to support large-scale operations.

SAP Business One provides an array of modules tailored for pharmaceutical businesses, including finance, accounting, inventory management, and customer relationship management. While it does offer some basic production functionalities, it is primarily designed for firms that need a reliable ERP system without the need for extensive IT resources.

| COST: | DEPLOYMENT: | SCALABILITY: |

| Medium | Cloud | 51 - 500 employeess |

QAD is a highly effective ERP system for mid-sized to large pharmaceutical companies, particularly those with complex manufacturing and supply chain requirements. QAD is designed to handle the unique challenges of the pharmaceutical industry, including strict regulatory compliance and intricate production processes.

Pharmaceutical and biotechnology firms that are scaling their operations often choose QAD for its robust support for both in-house and outsourced manufacturing. It excels in integrating and streamlining production, quality management, and supply chain processes, ensuring compliance with industry regulations such as GMP and FDA.

QAD offers a comprehensive suite of modules, including finance, manufacturing, supply chain, and quality management. As a Cloud ERP system, QAD provides scalability and flexibility, making it ideal for companies with substantial IT resources that need a powerful and adaptable solution to manage their complex operations and regulatory requirements.

| COST: | DEPLOYMENT: | SCALABILITY: |

| Medium - High | Cloud | 501 - 5,000 employeess |

Enterprise Resource Planning (ERP) systems play a key role in streamlining operations and ensuring regulatory compliance for pharmaceutical organisations. A Pharmaceutical ERP is a specialized ERP system designed to meet the unique needs of pharmaceutical and biotechnology companies. It integrates and automates various business processes, from research and development to manufacturing, supply chain management, and regulatory compliance.

Pharmaceutical ERPs are often Cloud-based, providing scalability, flexibility, and accessibility. This is particularly beneficial for companies with limited IT resources, as it reduces the need for extensive on-premises infrastructure and allows for easier updates and maintenance.

By implementing a Pharmaceutical ERP, companies can achieve greater operational efficiency, reduce costs, and ensure compliance with regulatory requirements. This integration and automation of business processes enable pharmaceutical companies to focus on their core mission of developing and delivering life-saving treatments to the market.

Comparing pharmaceutical ERP software requires you to understand and quantify many different elements of your own organisation and understand the benefits and disadvantages of various different ERP systems for the pharmaceutical industry.

First and foremost, regulatory compliance is critical. The ERP system must support compliance with FDA regulations, including 21 CFR Part 11 for electronic records and signatures, and adhere to Good Manufacturing Practices (GMP), Good Laboratory Practices (GLP), and Good Clinical Practices (GCP). The system should facilitate validation processes and provide documentation to prove compliance during audits, a necessity for maintaining regulatory standards.

Download our complete Top 10 Pharmaceutical ERP Report

The next consideration is the industry-specific features that the pharmaceutical ERP system offers. Batch management and traceability are essential for tracking raw materials and finished products through batch and lot numbers. Integrated quality management systems (QMS) are necessary to manage quality assurance and control processes effectively. Additionally, the system should provide formulation management capabilities to optimize product formulations and recipes, and support product serialization and track-and-trace capabilities to comply with regulations like the Drug Supply Chain Security Act (DSCSA).

Functionality and available modules are also crucial. The ERP system should offer robust production management capabilities, including production scheduling, process automation, and manufacturing execution systems (MES). Advanced inventory tracking for raw materials, work-in-progress (WIP), and finished goods is necessary, along with efficient procurement, supplier management, and logistics functionalities. The system should also include comprehensive financial management modules for accounting, budgeting, and cost management, as well as customer relationship management (CRM) and sales order processing capabilities.

Scalability and flexibility of the ERP system are vital to ensure it can grow with the business and adapt to changing industry requirements. The level of customization available should be evaluated to tailor the system to specific business needs.

Integration capabilities are another key factor. The ERP system should be able to integrate seamlessly with other systems such as Laboratory Information Management Systems (LIMS), Product Lifecycle Management (PLM), and third-party applications, ensuring smooth data flow and operational efficiency.

User experience and training are also important considerations. The system should have an intuitive user interface and be easy to use, with comprehensive training programs and support to ensure smooth user adoption.

Evaluating the vendor's reputation and support is essential. Assess the vendor’s experience and reputation in the pharmaceutical industry, and evaluate the level of customer support, maintenance, and service-level agreements (SLAs) provided.

To compare different ERP systems effectively, create a comparison matrix. Start by identifying specific requirements and features critical for your pharmaceutical business. Shortlist vendors based on initial research and known presence in the pharmaceutical sector. Create a detailed list of evaluation criteria and develop a scoring system to rate each ERP system. Arrange product demos with shortlisted vendors to see the systems in action, and speak with other pharmaceutical companies using these ERP systems to gain insights into their experiences.

For example, when comparing ERP systems such as SAP S/4HANA, Oracle ERP Cloud, Microsoft Dynamics 365, and Infor CloudSuite, consider factors like FDA compliance, batch management, quality control, and serialization capabilities. Use a scoring system to evaluate each system on criteria like functionality, scalability, integration capabilities, user experience, and vendor support. This structured approach ensures a comprehensive comparison, helping you select the ERP system that best fits your pharmaceutical business needs, ensuring regulatory compliance, operational efficiency, and long-term scalability.

For early stage pharmaceutical and biotechnology companies, research and development capabilities and features are key requirements of the system, allowing you to track costs, resources and returns on projects and new treatment research.

R&D features of pharma ERP may include:

Not all pharmaceutical companies requirement production capabilities in their ERP systems, particularly if they outsource production to contract manufacturing organisations, but for those that do, pharma ERP systems can provide features including:

Compliance is one of the top requirements for ERP systems for the pharmaceutical industry due to the tough measures and regulations put in place by organisations such as the Federal Drug Agency (FDA), MHRA and more.

Pharmaceutical ERP systems can help you to manage quality and compliance with features such as:

For organisations with production capabilities, whether in house or outsourced, supply chain management allows them you to ensure you have the raw materials and components required to make your products. Supply chain management is key when you have several ingredients or components with varying lead times and multiple suppliers and is an essential part of pharma ERP systems.

Pharma ERP supply chain management features include:

Pharmaceutical companies typically operate in multiple countries and accounting jurisdictions and require strong financial management and accounting capabilities in their ERP systems.

Pharmaceutical ERP software typically includes features covering:

Compliance is key in the pharmaceutical and biotechnology space and pharma ERP systems can enable this with features including:

Pharmaceutical ERP systems may also include fully fledged CRM capabilities with features including:

Many companies will opt for a siloed, 'best of breed' HRIS system, rather than having these capabilities within their ERP system, however some pharma ERP systems do include a complete set of HR capabilities including:

Reporting is key and pharmaceutical ERP systems typically include features to enable business intelligence such as:

The cost of an ERP system for the pharmaceutical industry varies widely depending on factors such as business size, system complexity, required features, vendor choice, and whether the deployment is cloud-based or on-premises.

Initial costs include licensing or subscription fees. On-premises systems often require significant upfront fees, from tens of thousands to millions of dollars. Cloud-based systems typically use a subscription model, costing $100 to $500 per user per month.

Implementation costs are also substantial. Consulting for customization and configuration can range from $50,000 to several million dollars. Data migration can cost between $10,000 and $100,000, depending on data complexity. Integration with existing systems like LIMS and CRM may add another $20,000 to $200,000.

Training and change management are critical for successful adoption. Training programs can range from $5,000 to $50,000, while change management initiatives can add $10,000 to $100,000.

Ongoing costs include maintenance and support fees, typically 15% to 25% of the initial licensing cost for on-premises systems. For cloud-based systems, these fees are included in the subscription. Regular upgrades and additional licenses for growing businesses add further costs.

Total cost of ownership (TCO) over five years can range from $250,000 to $1 million for small to mid-sized companies, and up to $20 million or more for large enterprises.

For example, a mid-sized pharmaceutical company with 100 users using a cloud-based ERP might face annual subscription fees of $120,000 to $600,000. Implementation costs could be $200,000 to $1 million, with training and change management adding $20,000 to $100,000. Ongoing costs might range from $50,000 to $200,000 per year.

In summary, ERP system costs for the pharmaceutical industry depend on deployment model, implementation scale, customization, and ongoing needs. Proper planning and understanding of business requirements are essential for managing these costs effectively and ensuring a successful ERP implementation.

Implementing an ERP system in the pharmaceutical industry can take anywhere from a few months to several years. The amount of time it takes depends on a number of factors - here are some of the considerations below:

Implementing a Pharmaceutical ERP system is a complex process influenced by various factors. As trusted advisors in the industry, here are some of the key factors that can affect the duration of an ERP implementation project:

The journey begins with the initiation and planning phase, where a thorough needs assessment is conducted to understand the organization’s requirements, including regulatory obligations, operational challenges, and future goals. During this phase, the scope of the project is defined, detailing the modules to be implemented, customization needs, and integration requirements. A project team comprising a project manager, IT staff, subject matter experts (SMEs), and key stakeholders from various departments is assembled, and an ERP vendor is selected based on factors such as industry experience, functionality, support, and cost. A detailed project plan is then developed, outlining timelines, milestones, resources, and risk management strategies.

The next stage involves business process analysis and design. This includes documenting current business processes, workflows, and system usage, followed by defining the desired future state with improvements and automation opportunities. A gap analysis is conducted to identify discrepancies between current processes and the ERP system’s capabilities, determining the necessary customizations. Detailed process maps and workflows are developed for the new system, ensuring they align with regulatory requirements.

System configuration and customization follow, where the ERP system is set up based on the defined business processes and requirements. Customizations are developed to address specific business needs and regulatory compliance requirements, and integrations with existing systems such as LIMS, CRM, and MES are planned and designed to ensure seamless data flow.

Data migration is a critical stage that begins with assessing the quality and volume of data to be transferred from legacy systems. Data cleansing ensures accuracy, completeness, and compliance with regulatory standards, followed by data mapping from legacy systems to the new ERP. The data migration is executed using automated tools and scripts to maintain data integrity and consistency.

Testing and validation are essential to ensure the system functions correctly and complies with regulatory standards. This stage includes developing a comprehensive test plan, conducting unit testing for individual modules, integration testing to ensure seamless data flow between systems, and system testing for end-to-end validation of functionality and performance. User acceptance testing (UAT) engages end-users to verify that the system meets their needs and expectations. Validation protocols are executed to ensure regulatory compliance, with thorough documentation of all test results.

Training and change management are critical to the successful adoption of the new system. A training needs assessment identifies the requirements for different user groups, and comprehensive training materials, including manuals, tutorials, and hands-on exercises, are developed. Training sessions are conducted for end-users, administrators, and IT staff. Change management strategies are implemented to address resistance and ensure a smooth transition, including communication plans and stakeholder engagement.

Go-live preparation involves developing a detailed plan, including cutover activities, resource allocation, and contingency plans. A final data migration ensures that the latest data is available in the new system, followed by final system validation to confirm readiness for go-live. User support mechanisms, such as help desks and support teams, are set up to assist users during the transition.

Best pharma ERP software and the top pharma manufacturing ERP modules that SME and large pharmaceutical companies need in Cloud and On Premise ERP.

We look at the top manufacturing ERP systems on the market and compare functionality, scalability, cost and more. Compare manufacturing ERP for 2024.

We independently compare Epicor and NetSuite, two of the most popular ERP systems for small, medium and growing businesses.

We analyse two of the most popular ERP systems on the market for small businesses, SAP Business One and NetSuite and compare functionality, cost and...

We compare NetSuite vs Microsoft Dynamics ERP. We analyse and compare the functionality and modules, industry fit, implementation and much more.

ERP Modules: What Are They? An ERP module is a software component or part of the ERP program that takes care of a particular operation.

Be the first to know about new B2B SaaS Marketing insights to build or refine your marketing function with the tools and knowledge of today’s industry.